Donations To Public Benefit Organisations

/Written by Roulon du Toit

A lot of South African taxpayers are unaware that they could reduce their taxable income if they made donations to Public Benefit Organisations. When a South African resident makes a donation, it is important to realise that there are tax consequences which may lead to either an increased tax burden or tax relief.

First, it is important to note that donating may attract a Donations Tax liability. This is something that taxpayers are unaware of and can be quite costly. We will not be exploring this in this blog, but be aware that if you donate cash (or any other asset) there may donations tax, especially if the value exceeds R100 000. For example, if you purchase a car and then transfer ownership to your child it will likely attract Donations Tax.

In this blog entry we will focus on donations made to Public Benefit Organisations (PBOs) and the tax benefits that come with this. Following on from the above, note that donating to PBOs is exempt from any Donations Tax liabilities.

What is a Public Benefit Organisation?

In terms of Section 30 of the Income Tax Act, a “public benefit organisation” is a non-profit organisation which has registered as such under the Companies Act. These organisations have also applied at SARS for a tax-exempt status.

What type of donation can you make to qualify for the deduction against taxable income?

You can donate either

Cash or

Assets (e.g. movable property, trading stock, immovable property)

We’ll focus on cash donations in this blog entry as it is the most common. Donations of other assets can be slightly more complicated, and we won’t discuss these here. Please reach out to us if you wish to know more about non-cash donations.

How does the tax deduction work?

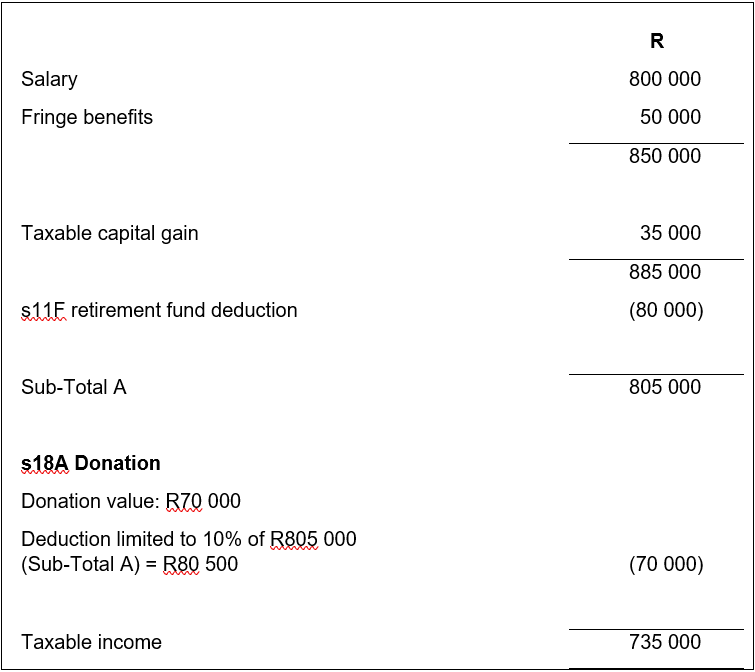

Section 18A of the Income Tax Act states that a taxpayer donating to a PBO can claim a tax deduction to the value of the donation made but limited to no more than 10% of the taxpayer’s taxable income before taking this deduction into account.

Practically, this means that the s18A deduction cannot exceed 10% of the taxable income calculated after considering all income, allowances, other deductions, and exemptions. The s18A deduction is thus the last step in the calculation of taxable income.

As an example, let’s assume the following:

Taxpayer A earns a salary of R800 000, fringe benefits of R50 000 and contributes R80 000 to a provident fund. The taxpayer also has a taxable capital gain of R35 000. Taxpayer A donates R70 000 to a PBO.

What happens if donations exceed the limit?

If the donation made exceeds 10% of the taxable income, the excess amount, which is not deductible in the current year, will be carried forward to the next year.

For example, if Taxpayer A had donated R90 000 to a PBO in the above example, this would mean only R80 500 could be deducted in this tax year. The excess of R8 500 (R90 000 – R80 500) will be treated as if it was a donation made in the next tax year.

What do you need to qualify for deduction?

Taxpayers qualify for the s18A deduction if they meet the following requirements

The donation is a bona fide donation, meaning it is made from genuine benevolence

The donation is to PBO that is registered as such with SARS

The PBO issues a receipt in terms of s18A which contains

The PBO’s name, address, and reference number

Date of the donation

Name and address of the donor

The amount of the donation or nature of the donation if is not cash

Certification that indicates that receipt is issued for purposes of s18A

If your employer made the donation to the PBO on your behalf, you would need an employees’ tax certificate that shows this.

Donating to a good cause is one of life’s most enriching endeavours. Make it even sweeter by reducing your personal tax burden.