Budget Speech 2022

/CHANGE IN CORPORATE TAX RATE

Written with Roulon du Toit

During the 2020 Budget Review, the government indicated that it intended to decrease the corporate tax rate by one percentage point from 28% to 27%. It has now been confirmed that this decrease will take place, effective for tax years ending on or after 31 March 2023. In other words, this will apply to any company whose tax year commences on or after 1 April 2022.

The decrease in the corporate tax rate hopes to stimulate investment and economic growth within South Africa. It should, however, be noted that there are other changes that temper this, such as the limitation on assessed losses that companies can claim which will come into effect at the same time.

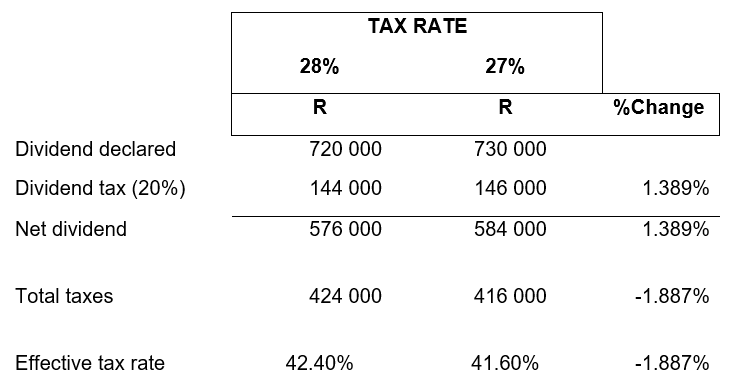

But we are accountants and enjoy numbers 😁, so let’s look at a simple comparison of the numbers, assuming a company with a profit before tax/taxable income of R1 000 000.

The decrease of one percentage point in the tax rate thus leads to a welcome 1.389% increase in net profits.

Let’s further assume that the same company declared these net profits to its shareholders, who are all subject to dividends tax.

The total taxes paid (income tax and dividends tax) thus decreases by 1.887%, reducing the effective tax rate from 42.4% to 41.6%.

CHANGE IN TAX TABLES

The tax tables applicable to normal persons has been adjusted and is shown below. Taxpayers with a taxable income exceeding R1 731 600 will now be paying tax at that maximum marginal rate of 45%.

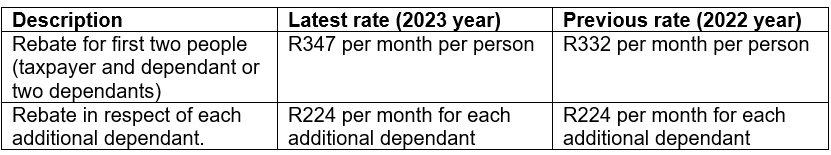

CHANGE IN REBATES

The government has increased the normal tax rebates by 4.5% and, consequently, this has increased the tax thresholds which are directly related to these rebates. The rebates are available to all natural persons. The tax threshold is the amount of taxable income that is tax free.

CHANGE IN s6A MEDICAL SCHEME FEES TAX CREDIT

As usual, the s6A medical scheme fees tax credit has been reviewed and updated for the 2023 tax year.

The medical scheme fees tax credits are available as a rebate against the tax payable by a natural person taxpayer and is available to all persons who pay fees to registered medical aids for themselves and/or their dependants. As a reminder, this is also applicable to persons whose employers provide them with membership to a medical aid as part of their fringe benefits from employment.

s6B ADDITIONAL MEDICAL EXPENSES TAX CREDIT

There have been no changes to the formula used to calculate the additional medical expenses tax credit which is available under s6B.

We’d like to remind everyone to keep an accurate record of any qualifying medical expenses incurred to consider it for the s6B rebate. Qualifying medical expenses are expenses which have not been paid/reimbursed by the medical aid and includes fees paid to medical professionals, nursing homes, hospitals as well as prescription medicine but it excludes “over-the-counter” medicine.

Further, it is worth mentioning that the manner in which the s6B credit is calculated differs between the following taxpayers:

Taxpayers younger than 65 where there is no disability

Taxpayers 65 or older

Taxpayers where there is a disability

It is important to be aware of this, especially if you have moved into a different category during this year.

ILLUSTRATION OF EFFECT OF CHANGES

For the sake of illustration, let’s assume that we are looking at a taxpayer, Mrs A.

Mrs A is married to Mr B. Mrs A’s spouse and their two children are registered dependants on her medical aid. Her monthly contributions to the medical aid amount to R5 000. Further, she incurred additional qualifying medical expenses, not covered by the medical aid, of R40 000 during the year.

Mrs A is 48 years old, and her taxable income was R300 000 during the year.